Total Compensation

Do you know what Total Compensation is?

Total Compensation is the value of both the benefits and the salary you receive once employed by the State of New Mexico.

Total Compensation simply means all forms of cash compensation and the dollar value of employer sponsored benefits. Total compensation can be further be defined as “the complete rewards/recognition package for employees, including all forms of money, benefits, perquisites, services and in-kind payments.” The State of New Mexico provides a competitive employee benefit package that includes: employer paid medical contributions, pension (PERA retirement) contributions, paid leave allowances for vacation days, sick days and paid holidays. Additionally, State employees can take advantage of a Section 457 Deferred Compensation Plan that allows for contributions to a tax-deferred savings program that can be used to supplement their retirement plan.

What is included in a Total Compensation package?

New Mexico provides a benefit package that includes employer-paid medical insurance contributions, retirement contributions and paid vacation days, sick days and holidays. Additionally, State employees may take advantage of a Deferred Compensation Plan to supplement their retirement plan.

You may also cover lawful spouses, unmarried, natural children up to the age of 26, adopted children, stepchildren and domestic partners.

What does Total Compensation look like?

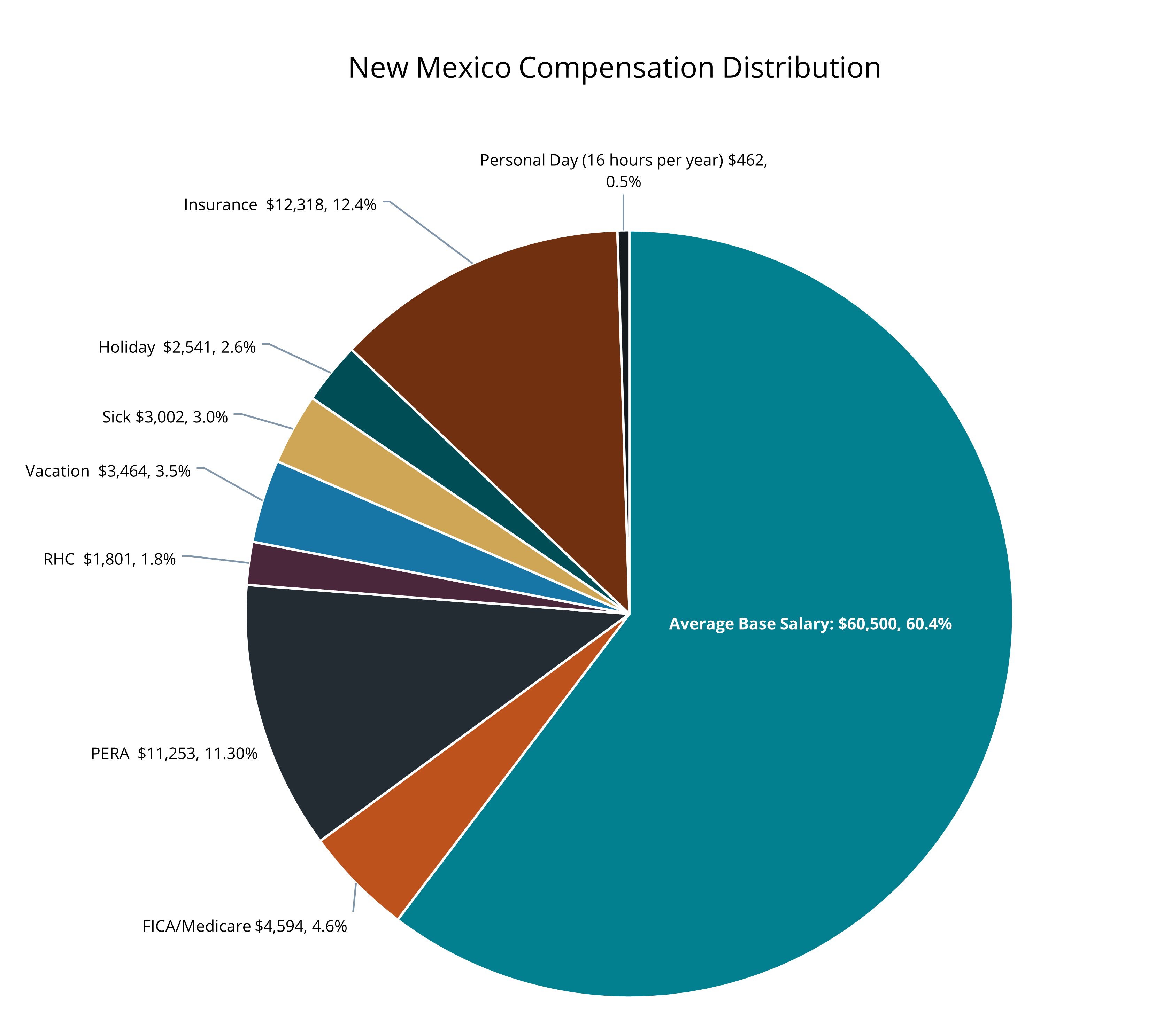

Below is a typical breakdown of our total compensation components for classified employees. The FY2023 average base salary is $60,049.60- 60.4% of total compensation. The remaining components (mandated benefits, insurance, and paid time off) are valued on average at $39,436 or 39.6% of total compensation – an average annual total compensation amount of $99,486.

What does the State contribute?

On average, the State covers the majority of benefit costs. To see contribution rates, follow the links below.

*Sample above based on Presbyterian family coverage in conjunction with family dental, vision, life and disability coverage.

| Average Base Salary: | $60,500 | 60.36% |

| Employer Sponsored Benefits and Average Value: | ||

| FICA/Medicare (6.2% / 1.45% of gross salary) | $4,594 | 4.6% |

| PERA (18.75% of gross salary) | $11,253 | 11.30% |

| RHC – Retiree Healthcare (3% of gross salary) | $1,801 | 1.19% |

| Vacation (80 hours per year) | $3,464 | 3.5% |

| Sick (104 hours per year) | $3,002 | 3.0% |

| Holiday (88 hours per year) | $2,541 | 2.6% |

| Insurance | $12,318 | 12.4% |

| Personal Day (16 hours per year) | $462 | 0.5% |

| Average Total Benefits | $39,435 | 39.71% |

| Average Total Compensation (Salary + Benefits): | $99,935 | 100% |