FY09 Union Lawsuit Information

Updates

September 17, 2018

- On September 14th, the State issued 568 checks to both current and former Multiple Component of Pay (MCOP) affected employees. These checks were calculated using the methodology agreed upon between the State and the Unions. The 568 checks were sent via certified US mail.

February 2, 2017

- Effective January 14, 2017, the State adjusted the base pay rate of 240 active state employees. This pay adjustment was due to a Multiple Component of Pay (MCOP) that caused an eligible employee’s revised compa-ratio to fall into a different increase bracket resulting in a new pay rate. This salary adjustment was necessary to institute a corrected pay rate moving forward and establish a definitive end date for the purposes of calculating retroactive pay due. Please note that this pay adjustment only applies to active state employees who were individually notified of the pay rate change. If you are an active state employee and were not specifically notified – your pay rate did not change. Retroactive pay calculations are ongoing for current and former MCOP affected employees.

April 13, 2016

- The week of March 21, the State issued an additional 25 additional checks, to both current and former employees. The week of March 28th, the State issued an additional check. To date, the State has conducted eighteen special payrolls and issued approximately 9,277 checks.

October 8, 2015

- The week of September 7, the State issued an additional 24 additional checks, to both current and former employees. To date, the State has conducted 16 special payrolls and issued approximately 9,251 checks.

June 18, 2015

- The week of June 18, the State issued an additional 69 additional checks, to both current and former employees. The week of June 1, the State issued an additional 27 additional checks, to both current and former employees. To date, the State has conducted fifteen special payrolls and issued approximately 9,227 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of July 13, 2015.

May 4, 2015

- The week of May 4, 2015, the State issued an additional 145 checks, to both current and former employees. To date, the State has conducted 13 special payrolls and issued approximately 9,140 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of May 18, 2015.

April 22, 2015:

- The week of April 20, 2015, the State issued an additional 207 checks, to both current and former employees. To date, the State has conducted twelve special payrolls and issued approximately 8,990 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of May 4, 2015.

March 25, 2015:

- The week of March 23, 2015, the State issued an additional 327 checks, to both current and former employees. To date, the State has conducted eleven special payrolls and issued approximately 8,780 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of April 6, 2015.

March 9, 2015:

- The week of March 9, 2015, the State issued an additional 596 checks, to both current and former employees. To date, the State has conducted ten special payrolls and issued approximately 8,450 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of March 22, 2015.

February 24, 2015:

- The week of February 9, 2015, the State issued an additional 648 checks, to both current and former employees and the week of February 23, 2015, the State issued an additional 617 checks, to both current and former employees. To date, the State has conducted nine special payrolls and issued approximately 7,750 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of March 9, 2015.

January 27, 2015:

- The week of January 26, 2015, the State issued an additional 873 checks, to both current and former employees. To date, the State has conducted seven special payrolls and issued approximately 6,550 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of February 8, 2015.

January 20, 2015:

- The week of January 12, 2015, the State issued an additional 884 checks, to both current and former employees. To date, the State has conducted six special payrolls and issued approximately 5,800 checks. Barring any unforeseen circumstances, the next special payroll is scheduled for the week of January 26, 2015.

January 2, 2015:

- The State is working hard to complete this project as soon as possible. We continue to work diligently with our vendor to complete implementation and do not have any incentive to prolong completion. Our vendor has explained that the remaining calculations are more complex and require several hours each to calculate. Additional time beyond that is necessary for validation of each calculation.

- The week of December 15, 2014, the State issued an additional 222 checks, most to current employees. To date, the State has conducted five special payrolls and issued nearly 5,000 checks.

- The State is preparing to run another special payroll the second week of January after the conclusion of the regular payroll process. We are committed to running special payrolls and producing back-pay checks as often as completed and verified calculations are received from the vendor, subject to the regular payroll constraints.

- Our focus continues to be on ensuring that calculations are accurate before processing checks.

FY09 Pay Package Arbitration FAQs

What is the FY09 Pay Package Arbitration?

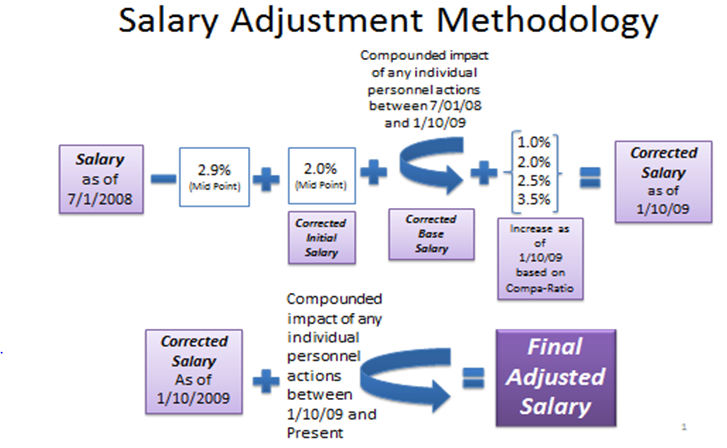

On July 1, 2008, all State employees received a salary increase equal to 2.9% times the mid-point of their salary grade. Arbitrators decided that bargaining unit employees in FY09 should have instead received: (1) a “General Salary Increase” based on 2.0% of the midpoint of an employee’s pay band on July 1, 2008; and, (2) an additional “Within Band Salary Increase” based on the employee’s compa-ratio effective January 10, 2009. Compa-ratios are determined by dividing the employee’s rate of pay by the rate of pay of the midpoint of the employee’s pay band.

Based on the terms of the collective bargaining agreement and the arbitration award, The State re-calculated and implemented eligible employees’ hourly wages (Phase 1) on June 7, 2014.

The State’s independent contractor has also applied the re-calculated (Phase 1) pay rates to the number of hours worked in order to determine the back wages due (Phase 2) to each eligible employee.

Who is eligible to receive a salary increase (Phase 1) and/or back pay (Phase 2) pursuant to the FY09 Arbitration Awards?

Generally, eligible employees must have: (1) been in a permanent status, completed their probationary period and received the legislative increase between July 1, 2008 and June 30, 2009, and, (2) been bargaining unit members of AFSCME or CWA on the date of that legislative increase. Additionally, eligible employees must not have separated or moved to a non-union position before January 10, 2009. Eligible employees that are currently employed by the State should receive both a Phase 1 salary increase, and Phase 2 back pay. Eligible employees that have separated from the Executive Classified salary plan will only be eligible for Phase 2 back pay.

The Eligibility Review process closes on October 31, 2014.

Please follow the procedure outlined below:

- Check the website using the below links to see if you meet the eligibility requirements.

- Check the Phase 2 eligibility list to see if your employee ID has been identified as eligible.

- If your employee ID is on the list, please proceed to verify your address on the link below, titled “Address Verification.” Nothing further is required. DO NOT SUBMIT AN ELGIBLITY REVIEW FORM IF YOU ARE ON THE LIST.

- If your employee ID is not listed, only then do you need to submit an Eligibility Review Form.

Current Eligible Employees (Phase 2 Only)

(click the link above to see if you are on the current eligibility list – sorted by employee ID number)

Phase 2 Eligibility Determination Review Form

(Form works best in Internet Explorer. If the form asks you to update to the latest version of Adobe Reader, please right click within the page that DID open and save it to your desktop. Click here to view instructions.)

Address Verification

To begin the address verification process, you will need your 6-digit PeopleSoft employee ID. If you do not know your ID number, please contact your last employing agency HR office. Once you have authenticated your address you will not be allowed any changes. Please note: If your employee ID does not populate an address as being identified as eligible, follow the instructions at the following link for eligibility review: http://www.spo.state.nm.us/fy09-union-lawsuit-information

Address Verification Form

When will employees eligible for Phase 2 back pay receive it?

The State continues to work through this process with its independent contractor, and we are preparing additional special payrolls. The pending uploads involve more complex calculations, which has required more time for calculation and validation. We are continuing to work closely with the independent contractor to put together a schedule for special payrolls based upon the contractor’s ability to complete the remaining calculations. To date, approximately 4,200 checks have been processed.

To date, we were able to run special payrolls on September 17, October 1, and October 30, 2014.

We will continue to run special payrolls as we receive completed calculations from our independent contractor, subject to the regular payroll constraints. If you are an eligible employee and you did not receive your check during the last two special payrolls, you will receive your check during one of the future special payrolls.

WE TRULY APPRECIATE YOUR PATIENCE AS WE WORK THROUGH THIS COMPLICATED PROCESS.

Current Employees

Current employees will receive manual warrants from their agencies’ HR Bureaus as they become available. Current employees will be required to show identification, and sign for the receipt of their warrants. Manual warrants will not be available by agency or alphabetically; thus, it is possible that employees at the same agency will receive manual warrants at different times. We appreciate current employees’ patience in this regard. Checks are not available by agency or alphabetically because the State’s independent contractor sorted the calculations by level of complication for purposes of validation. Thus, it is possible that employees at the same agency and employees that have separated or retired will receive checks at different times depending on which special payroll they fall into. We appreciate your patience in this regard.

Please note that if you cannot retrieve your check from your HR Manager, your check will be mailed to you via certified mail. You do not need to travel to retrieve your check.

Former Employees

Former employees should update their addresses on the State Personnel Office website: http://www.addressverify.spo.state.nm.us/. Former employees will receive their manual warrants by mail sometime after the special payrolls have been completed. If former employees do not update their addresses by October 31, 2014, their checks will be mailed to their last known address of record.

Is the calculator AFSCME posted on its website an accurate indication of how much money eligible employees will receive?

No. The State, AFSCME, and CWA have agreed upon a more accurate method of calculating the salary increase and back pay. Additionally, the calculator fails to take into account the legislative salary increases that applied to all State employees, or each employee’s individual salary history.

How were the Phase 1 adjustments calculated for eligible employees?

Below, please see the graphical depiction of the methodology agreed upon by AFSCME, CWA, and the State:

How was the Phase 2 back pay calculated for eligible employees?

Gross back wages were determined based on the difference between what eligible employees were paid, and what eligible employees should have been paid, times the number of hours worked by each eligible employee. Subsequent salary changes, multiple components of pay, and overtime hours are all considered. Mandatory deductions (taxes, Public Employees Retirement Association contributions, etc.) will be taken out, in order to arrive at the net back wages figure.

Eligible employees receiving back pay will be issued an itemization, outlining their gross back wages, required withholdings, and net back wages.

The State will submit its portions of required contributions to the Internal Revenue Service, Taxation and Revenue Department, Public Employees Retirement Association (“PERA”), and Retiree Health Care Authority.

What was the average Phase 1 increase?

The currently calculated average Phase 1 increase is approximately nineteen cents per hour ($0.19/hour).

What is the average Phase 2 back pay amount?

Individual back pay amounts will vary due to each individual’s unique circumstances and events in their job history.

When will PERA be able to proceed with correcting the contributions and retirement pay for eligible retirees?

According to PERA, after Phase 1 and Phase 2 calculations are complete, and PERA receives the Phase 1 and Phase 2 data from the employer for each eligible employee, then PERA will begin to perform its calculations.

Any questions regarding the impact of the FY09 Arbitration Awards to PERA should be directed to PERA.